Perodua sales at 52% & Proton sales at 8.8%… Why?

Based on indicated sales data for May 2018, Perodua’s market share of vehicles sold in Malaysia stands at 52%. More than half of the cars sold in Malaysia are Peroduas. Proton, on the other hand, while subject to many of the same tax and duty advantages have only managed a market share of 8.8%.

I thought I’d try and explore some of the reasons for this. After all, I’ve driven just about every Proton and Perodua on sale today and found Proton’s cars to be more appealing to me, a driver and petrolhead. So, why shouldn’t they be selling just as many cars as Perodua? Let’s start with the more objective reasons and work towards more subjective stuff.

Market Overview

The Malaysian market is small. Our population of 30-something million is positively tiny next to Indonesia’s 300-something million or the 100-something million of the Philippines. Even Thailand’s population is double ours. Myanmar’s is something like 50 million, and Vietnam’s in the low 90s. But 30 million is not an insignificant number. We’re not at Singapore or even Brunei where local assembly becomes a laughable idea.

Just looking at Perodua’s progress and success over the decades, you can easily tell that local car production IS viable. They’ve managed to find a way to do it, from engine to transmission to final assembly – the whole car can be conceptualized, tested, and produced right here in Malaysia for a profit. Sure, Perodua takes proven parts from Daihatsu and Toyota’s parts bin, but we’ll explain just why this is completely acceptable later.

For now, let’s look at the product portfolio difference.

A Tight Product Portfolio

Looking at Proton’s product range, they’ve got every base covered with something relatively modern.

An A-segment sedan – the Saga, a B-segment hatchback – the Iriz, a B-segment sedan – the Persona, a C-segment sedan – the Preve, a C-segment hatchback – the Suprima S, a compact MPV – the Ertiga, a mid-sized MPV – the Exora, a D-segment sedan – the Perdana. Basically, every little niche is represented.

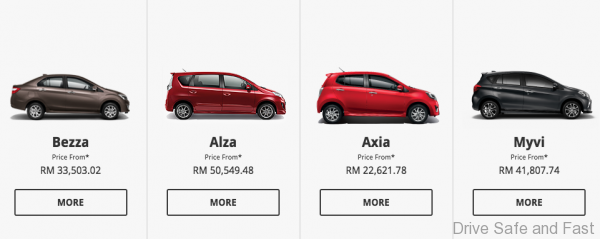

Perodua, on the other hand has just an A-segment hatchback – the Axia, an A-segment sedan – the Bezza, a B-segment hatchback – the Myvi, and a compact MPV – the Alza.

Proton literally has double the number of vehicles on sale compared to Perodua. In fact, Perodua, over the years have been very cautious with their portfolio. They have introduced vehicles like the Kembara, the Nautica, the Rusa, the Kelisa, the Kenari – and none of these ever overstayed their welcome. The moment Perodua sensed the business case for the product no longer existed, these products were phased out. When one product started eating away too many sales of another’s, rationalisation would be done. That’s how you run a business where profits AND risks can be enormous.

With Proton, there were multiple instances over the years where products overlapped. The first Saga/Iswara sold next to the Wira. The Wira, sold next to the Waja. The Waja sold next to the Persona. The Persona sold next to the Inspira and Preve.

7 (1985-2008)

(1985-2008)

(1993-2009)

(1993-2009)

(2000-2011)

(2000-2011)

(2007-2016)

(2007-2016)

(2010-2015)

(2010-2015)

(2012-Present)

(2012-Present)

The last overlap was only resolved in mid-2016 when the Persona was reimagined as a B-segment sedan based on the Iriz platform. And even after the 2016-restructuring of Proton, the overlap continued in another sense, one that we will address in the next point.

Price Sensitivity

It’s not just Perodua who has understood the Malaysian market – carmakers like Honda and Mazda also have a very good sense of where things lie. To us automotive enthusiasts, bloggers, journalists, price point and value is just a number. We can compare one car to another and come to a conclusion that a sub-RM200,000 BMW 318i is good value for money.

But the real world doesn’t work like that. Yes, there are tens of thousands of Malaysians who can afford to purchase cars of that category every year.

But to earn a 52% market share, you need to understand that most POTENTIAL Malaysian car buyers don’t want to own cars. They buy cars out of necessity. Public transport, while improving, is still horrendous in most parts of the country. Even where things have improved, Malaysian weather is simply not great for that method of travel for most white collar workers. The possibility of arriving to work drenched in sweat or rain is just too high.

Now, on top of this, you have a lot of Japanese competition with local production capabilities. B-segment hatchbacks and sedans are a huge deal for Honda, Toyota, Nissan, and the like. They compete around the RM65k-90k bracket and trust me, you don’t want to compete in this space. The fighting here can get very viscious between brands.

For Perodua, all of their cars cost less than RM65K. The new Myvi, that aims to take some sales away from Japanese makes, goes the extra mile in terms of safety and kit to make a convincing case for itself. The Alza is there for all big families on a tight budget. The Axia is diverse enough to serve driving schools, first-time buyers, and just about anyone who needs something reliable at home. And the Bezza adds a boot for those who just need a little more luggage hauling capability.

For Proton, the overlap of model types/sizes may be cleared, but in terms of pricing, it’s a bit of a Venn Diagram. Shopping for a Proton just isn’t quite as straightforward. The Saga is fine. But the Iriz and Persona fight in the same bracket. The Suprima S costs more than a full-spec Preve without being faster or more practical (though it does have better equipment). The Exora and Ertiga exist within RM3000 of each other. And the Perdana takes on the used Accord market.

Margins, Scale and Cost Effectiveness

Between RM22,622 and RM59,346 (RM36,000 gap), Perodua offers 21 variants of their 4 models. At this level, Perodua understands the most cost-effective way to make money is to focus on trim levels. 21 flavours (plus Gear Up accessories) under RM60,000 using an estimated 2 platforms, 4 engines, 2 transmissions. Any variations between these platforms, engines and transmissions is usually a modification, not a complete redesign. Even the new Myvi builds on the previous car’s chassis rather than starting from scratch.

Between RM33,124 and RM134,395 (RM101,000 gap), Proton offers 23 variants of their 8 models. To compound the problem, Proton relies on at least 5 platforms, 9 engines, a 5-speed manual from Getrag, a 5-speed manual from Aisin, a 4-speed automatic from Aisin, a 5-speed automatic from Honda, and CVTs from Punch. One way to get costs down is through scale. If you’re ordering multiple parts from multiple sources, scale is impossible to achieve.

*If any of our numbers are off, we apologize. We’re using rough guesses based on what information is available to us.

Baby Steps

I’ve said it multiple times, Proton’s cars drive extremely well. Even an RM30,000 base model Saga has the confidence and poise lacking in some Japanese makes costing twice that. But performance is for enthusiasts. The budget car game really is about so much more.

Cars aren’t cheap to make. Tens of thousands of components, many of which are immensely complicated, need to work together safely and over an extended period of time. The only way so many people can afford cars is, again, through the power of scale.

Perodua’s latest Myvi 99.99% Malaysian designed and produced by Malaysians, but they took baby steps to get there. And even now, most of the major components had been developed by Toyota or Daihatsu before, and Perodua had to adapt and modify according to their specifications. Why reinvent the wheel, especially when your competitors sell monthly what you sell annually. (Kia alone sold 250,000 cars in May 2018)

And yes, Proton’s use of Suzuki and Honda for the Ertiga and Perdana respectively makes sense, but to us, they should have grown with Mitsubishi the way Perodua grew with Daihatsu. Had Proton stuck to a realistic plan, we’d probably have a genuinely competitive brand that can cater to the expanding markets across South East Asia, South America and Africa.

Instead, it formed an unproductive relationship with Mitsubishi and was steered in different a direction every few years. At its peak, Proton controlled 63% of the Malaysian market. Maybe under Geely, those days will return. But Proton needs to take the business of selling cars seriously and cut out all those who are involved just for a quick buck.

One Response to Perodua sales at 52% & Proton sales at 8.8%… Why?