It’s time to acknowledge that Chinese cars are dominating the market worldwide.

Many Malaysians are still not convinced that Chinese carmakers are serious about taking on the Japanese but the latest numbers from Nikkei show a different story. For the first time in over two decades, Chinese automakers are projected to outsell their Japanese counterparts globally. The report shows that Chinese OEMs are projected to sell 2 million more vehicles worldwide than their Japanese counterparts.

The forecast, which aggregates data from automaker disclosures and S&P Global Mobility, includes both passenger and commercial vehicles across domestic and export markets.

- China: ~27 Million Units

- Japan: < 25 Million Units

This shift represents a significant changing of the guard. For context, Japan became the number 1 automobile seller worldwide in 1980. It took their industry something like 30-40 years to establish dominance. Japanese sales peaked at nearly 30 million vehicles in 2018 but have since faced declines in key markets like the United States and China itself. In contrast, Chinese automakers have surged, driven by a massive domestic appetite for electric mobility and an aggressive export strategy. The Chinese automotive industry was slow from the 1950s-1980s, only rebadging and making utilitarian vehicles for domestic use. It was only in the 1990s where joint ventures picked up steam and local brands began to expand. By the 2000s, China started exporting vehicles in earnest.

China’s leadership is heavily bolstered by its domestic market, which accounts for roughly 70% of total sales by Chinese automakers. China itself is the world’s largest single market for vehicles and foreign makes have been losing ground progressively there.

That being said, the primary catalyst is the explosion of New Energy Vehicles (NEVs). Battery-electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) now make up nearly 60% of all passenger car sales in China. This dominance has allowed local giants to capture market share that was previously held by foreign joint ventures.

Top players like BYD and Geely have now entered the global top ten automakers by sales, while Chery continues to lead as one of the country’s largest exporters.

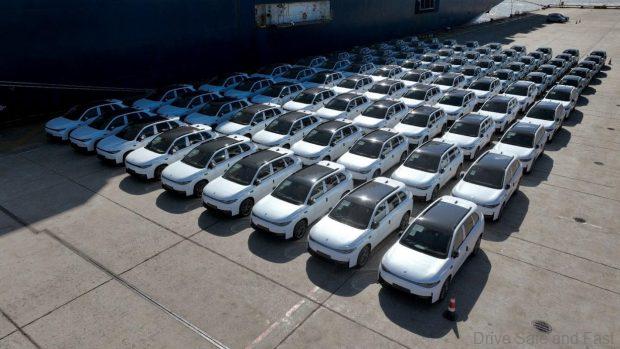

Despite facing tariffs in regions like Europe, Chinese vehicle exports continued to grow in 2025. The continent has long been dominated by… well continental brands from Germany, France, Italy and what’s left of the UK. This year though, about 2.3 million Chinese vehicles are expected to be sold there thanks to favourable taxation rules for PHEVs.

Carmakers like Chery and GWM have been working away at smaller markets worldwide such as Latin America, Africa, Oceania and the Middle East. While the gains here have been small in terms of overall figure, percentage-wise the growth it substantial for Chinese makes. Growth in Latin America is 33% for Chinese automakers, for instance. Latin America and Africa have been long dominated by a mixture of Japanese, American and legacy European brands, but the Chinese are delivering high-value-for-money vehicles and there and it’s starting to work.

Finally in our own part of the world we can see with our own eyes just how rapid the explosion has been. Half a million Chinese vehicles would have been registered across South East Asia by the end of the year, dwarfing Perodua’s own record breaking numbers, but you have to remember that most of these Chinese vehicles are substantially more expensive than Perodua’s models and many do not enjoy a protected budget market. They are forced to compete not only with long-established makes but with each other. Not an easy task for any brand facing massive stigma, so the results are impressive. If the Japanese makes don’t re-evaluate their strategy, this might end up being their Nokia moment.

The 2025 figures reflect a fundamental structural change in the automotive world. While Japanese brands remain global giants, their gradual decline in market share in China and the US contrasts sharply with the meteoric rise of China’s tech-focused, EV-first manufacturers.

As 2026 approaches, the gap is expected to widen further as Chinese brands continue to scale production and expand their global footprint.