Tune Protect has a Motor Insurance for Low Mileage Users

Tune Protect, the financial holding company involved in the insurance and reinsurance business, had its AGM this week. There were a few interesting announcements, but we’re going to get into that. What was really interesting to us was their unique motor insurance policy.

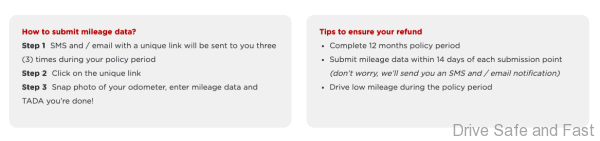

Tune Protect, has a product for Malaysian motorists called PAYD (Pay as You Drive). As the name implies, this product is uniquely tailored for those who don’t drive their cars too often.

If your annual usage is below 6000km, you get a 20% refund at the end of your term. If your usage is between 6001km and 8000km, you get a 15% refund instead. The refund is on your basic premium paid.

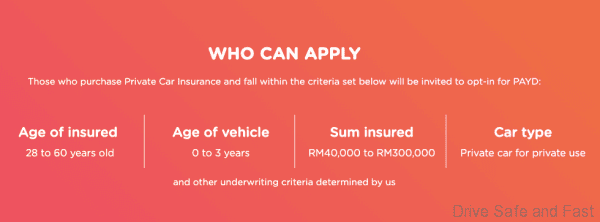

There are a few caveats here. Owners of classic or vintage cars need not get excited as this insurance is only open to vehicles between 0-3 years. Disappointing. The insured person needs to be between the ages of 28-60 years. The sum insured must be between RM40,000 and RM300,000. And only private cars for private use is covered.

The event covered a lot more of Tune Protect’s plans for expansion. You can read about it below.

Press Release:

Tune Protect Group Berhad (“Tune Protect” or “the Group”) held its 8th Annual General Meeting (“AGM”) of shareholders for the financial year ended December 31, 2018 today in The Vertical, Bangsar South under the leadership of Khoo Ai Lin (“Ai Lin”),Group Chief Executive Officer. Tune Protect is a financial holding company involved in the business of general insurance and reinsurance through its subsidiaries, associate and joint venture companies, as well as network of local underwriters across several regions.

In a press conference held after the AGM, Ai Lin shared that Tune Protect was on an exciting journey, having unveiled its transformation pillar GAIN, in 1Q2019. The Group remains committed in its digitisation journey, which is aligned with its 3 strategic pillars of product innovation and differentiation; wider distribution reach; and exceptional customer experience. This commitment is further amplified with the introduction of the GAIN transformational pillars, namely 1) Global Business, 2) AirAsia Ecosystem, 3) Insurtech Capabilities and 4) National Business.

The Group is upbeat as it had made some positive inroads in its GAIN journey.

GLOBAL BUSINESS

Tune Protect looks to expand its global business from Travel reinsurance business to other retail and lifestyle lines of businesses, as well as market its insurtech solutions focusing primarily on Indonesia, Indochina and the Middle East markets. In 1Q2019, Tune Protect signed a Memorandum of Agreement (‘MoA’) with PT Asuransi Buana Independent (‘ABI’) and the Association of Indonesian Tours and Travel Agencies (‘ASITA’) East Java. This MoA bestows Tune Protect the exclusive rights to provide digital travel protection for ASITA East Java. With Indonesia being one of the world’s largest and most vibrant domestic markets, Tune Protect seeks to position itself as a leading digital insurer by securing strategic partnerships locally and providing travellers in Indonesia with exceptional travel experiences. Tune Protect is currently working on forming similar tie-ups with additional ASITA chapters in other parts of Indonesia, and targets to gain entry into Indochina next.

AIRASIA ECOSYSTEM

Tune Protect is cognisant of the many opportunities to drive further growth across the AirAsia Group and Tune Group ecosystems. Tune Protect’s Dynamic Pricing optimisation initiative has started to yield positive results since going live in several key markets in 1Q2019. Post the integration and stabilisation phase, real time optimisation of Travel insurance on AirAsia’s booking platform commenced on a staggered basis in Indonesia, Thailand, Singapore and Malaysia during the first quarter of 2019. While it is still early days, preliminary results have been encouraging.

Travel protection remains a key revenue driver for Tune Protect. As such, the Group is constantly looking for innovative ideas to reward its AirAsia Travel policyholders. Tune Protect recently teamed up with mobile virtual network operator Flexiroam Sdn Bhd (“Flexiroam”) as the first in the market to provide complimentary 1GB high speed data roaming in over 150 countries to among others customers who purchase travel protection with their AirAsia fare (excluding value pack and premium flex). This way, customers can be assured of complete, worry-free Travel protection and internet connectivity while abroad.

INSURTECH CAPABILITIES

As one of the Group’s key transformation pillars, Tune Protect continues to invest in its InsurTech capabilities through the development of digital solutions and platforms which has opened doors to new business opportunities in the region.

Today, the Travel insurance business generated from the ABI and ASITA strategic partnership is powered by Tune Protect’s scalable B2B platform. With this solution, up to 7,000 travel agents of the East Java ASITA chapter can promote and distribute Travel insurance through a fully digital channel.

Leveraging on its homegrown InsurTech capabilities, the group will also be further expanding its B2B footprint to the Middle East and Indochina.

NATIONAL BUSINESS

During the press conference, Ai Lin introduced William Foo (“William”) who was appointed the Chief Executive Officer of Tune Insurance Malaysia Berhad (“Tune Protect Malaysia”), effective 8th May 2019. William brings with him more than 25 years of experience and a solid track record, having helmed various key roles within the general insurance industry including Distribution Management, Marketing, and Operations. Prior to joining Tune Protect Malaysia, William was the Chief Operating Officer for the Malaysian operations in a multinational insurance company.

For the general insurance business in Malaysia, the focus moving forward is on building sustainable underwriting profit. As such, the desired portfolio shift is towards retail non-motor and small medium enterprise (SME) / small medium industry (SMI) businesses.

In addition to the current range of innovative products such as pay-as-you-drive (PAYD) motor insurance and foreign workers cover, Tune Protect Malaysia also announced that they will be launching a new product – Business Shield, for the SME/SMI market, soon. Business Shield would provide business owners with complete protection as it would be a packaged product which covers common risks such as Fire insurance, Burglary, and Public Liability protection for the business premise and owner, as well as provide optional additional cover to suit the demanding needs of any business.

FINANCIALLY SOUND

Tune Protect believes in delivering sustainable underwriting profit from the general insurance and reinsurance entities within the Group, as well as from new income streams in order to consistently provide healthy returns to its shareholders. The GAIN aspiration will propel Tune Protect towards meeting these deliverables.

As of end of FY2018, Tune Protect Group announced improved corporate earnings with profit after tax (PAT) of RM52.9 million, representing a 5.8% year-on-year increase underpinned by a rationalisation exercise conducted in the last quarter of last year, in tandem with its digital transformation plan to drive efficiency and optimisation. Operating revenue increased by 4.3% to RM566.1 million undergirded by higher investment income. The Group is expected to announce its 1Q2019 financial results later that evening.

The Company had declared a dividend payout of 3.00 sen.

For more information about Tune Protect Group’s 2018 Annual Report, please visit the official website at https://www.tuneprotect.com/