Edaran Tan Chong Sees Mammoth RM50.7 Million Net Loss For Q323

Edaran Tan Chong revealed its net figures as of 30 September 2023 and it is bad

Well, we knew that with all the inflation, price hikes and somehow still stagnant salaries, that 2023 will not have been a very good year for the automotive sector. Despite the raw materials and chip shortage from last year and early this year being mostly solved, many carmakers still did not experience enough success to break even.

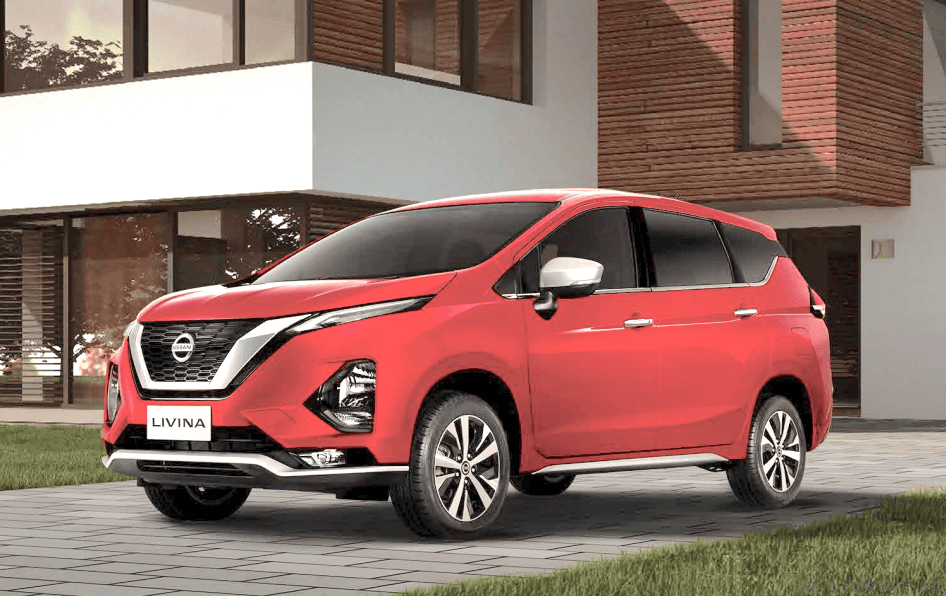

Edaran Tan Chong, the official distributor of Nissan in Malaysia is no different as it has reported a net loss of RM50.7 million for its third quarter of the year ending on 30 September 2023. This is a complete 180 from the company’s net profit of RM6.88 million during the same period last year.

Moreover, as previously mentioned, there were many external factors which saw the local market being and overseas markets being rather weak as more stringent competition coupled with inflation led to the market being far more volatile than it was this year. This makes the net loss even more painful for Edaran Tan Chong.

Edaran Tan Chong also saw revenue drop by 10.97 percent to RM649.82 million from RM729.87 million and this was apparently due to the entire automotive sector contributing less. The company said this in a filing to Bursa Malaysia and whether or not this is really the case, it is not looking good for many automotive brands here.

As opposed to the previous quarter, Edaran Tan Chong also saw its net loss increase compared to the RM18.13 million which it recorded in the second quarter of 2023. Strangely, this net loss came despite the company seeing its revenue increase from RM619.19 million.

On top of that, throughout the nine month period of fiscal year 2023, Edaran Tan Chong recorded a substantial net loss of RM73.9 million as compared to a much more meagre RM6.4 million loss over the same time period last year. So if the market was much more stable this year, then why did the company see bigger losses?

Well, Edaran Tan Chong claims this was due to lower sales and smaller profit margins that was caused by the weakening ringgit and lower foreign exchange rates from transactions and outstanding balances in foreign currencies. This time period also saw the company’s monthly income drop 18.18 percent to RM1.89 billion from RM2.31 billion as well.

However, regardless of all this, Edaran Tan Chong says that despite all the challenges and stiffer competition that it has to face, the company’s aim to build a sustainable business remains a top priority for it.

We got all this from Berita Harian Online and their full article is linked here. Thank you Berita Harian Online for the information and images.