Maybank Predicts EVs To Outsell ICEVs From 2035

Of course, local governments will need to provide ample charging networks, as well as EV-friendly policies and incentives for this to come true

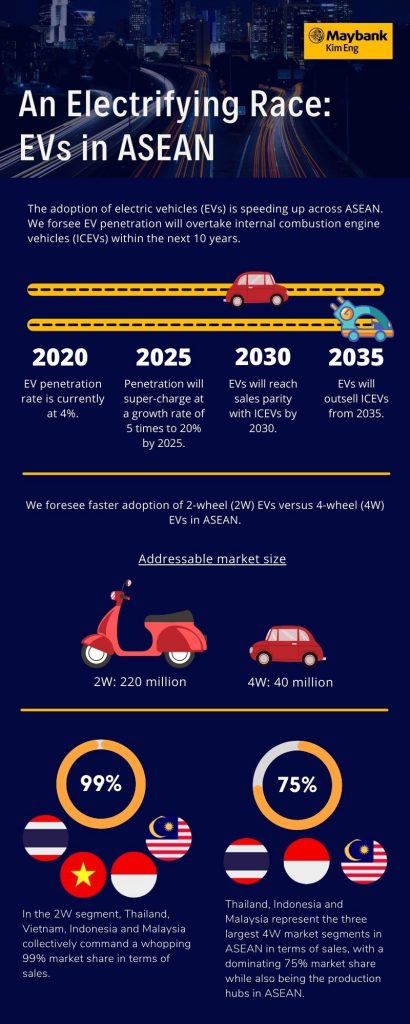

A report published by Maybank Investment Bank Research (Maybank IB Research) says that electric vehicles (EV) penetration is set to see a fivefold increase to 20% by 2025. The bank’s research arm also predicts that EVs will outsell internal combustion engine vehicles (ICEVs) from 2035.

Here are some of the key takeaways from the report:

- ASEAN has 40 million four-wheel (4W) vehicles and 220 million two-wheel (2W) vehicles

- Thailand, Indonesia and Malaysia represent the three largest 4W market segments with 75% market share

- Thailand, Vietnam, Indonesia and Malaysia represent 99% market share in the 2W segment

- Thailand, Indonesia and Singapore are leading in terms of developing EV-friendly policies

- Malaysian consumers are very price-sensitive and pro national cars

- Key drivers for EVs in ASEAN include falling costs, consumer preferences for cleaner and greener lifestyles, as well as government policies

- EV adoption in ASEAN still at an early stage, at a penetration rate of below 1%

- Challenges in the adoption of EV include affordability, charge time required, operating range, reliability and availability of charging stations and model options

- Our Low Carbon Mobility Blueprint has many positives but is skewed towards PHEVs and not BEVs

- Recurring fiscal incentives, one-time fiscal incentives and non-fiscal incentives could boost EV demand

- ASEAN should look at attracting China’s EV investment and at potential EV partnerships

PRESS RELEASE

Electric vehicles (EVs) are set to reach sales parity with internal combustion engine vehicles (ICEVs) by 2030 and outsell ICEV from 2035, according to Maybank Investment Bank Research (“Maybank IB Research”).

EV penetration stood at 4% in 2020 and is set to grow five times to 20% by 2025. This is significant for ASEAN, which has an addressable market of 40 million units in the 4-wheels (4W) and 220 million units in the 2-wheels (2W) segments respectively.

Thailand, Indonesia and Malaysia represent the three largest 4W market segments in ASEAN in terms of sales, with a dominating 75% market share while also being the production hubs in ASEAN.

In the 2W segment, Thailand, Vietnam, Indonesia and Malaysia collectively command a whopping 99% market share in terms of sales.

Liaw Thong Jung, Associate Director, Maybank IB Research, said: “Thailand, Indonesia and Singapore remain ahead of the pack in terms of developing EV-friendly policies. On the other hand, Malaysian consumers are very price-sensitive and pro national cars, whereas the Philippines prefers motorcycles. Fuel subsidies in the latter two countries also contribute to higher consumer preference for ICEV.”

“We foresee faster adoption of 2Ws versus 4Ws in ASEAN,” he added. Key drivers for EVs in ASEAN include falling costs, consumer preferences for cleaner and greener lifestyles, as well as government policies. However, ASEAN automotive markets are still very focused on ICEV, with EV adoption still at an early stage, at a penetration rate of below 1% for now.

Challenges that stand in the way of accelerating EV adoption include affordability, charge time required, distance or range between charges, the reliability and availability of charging stations, as well as the variety in options of EV models.

Establishing an ‘essential public charging network’ is a strategic first step. This remains a challenge in Malaysia, which has 421 charging points as at March 2021 and targets to increase this to 125,000 by 2030.

Government policy in the form of incentives could support the development of infrastructure as well as improve affordability of EVs. Meanwhile, original equipment manufacturers (OEMs) must spearhead innovation in terms of battery reliability and technology.

On Malaysia’s Low Carbon Mobility Blueprint 2021-30, Liaw said: “We see many positives from this, such as plans for EV infrastructure, electrifying the public transport system and 2W segment, a fuel levy (RM0.01/L) on all petrol and diesel purchases, and incentive or penalty for diesel emission level compliance.

“That said, the EV policy is skewed towards PHEVs (Plug-in Hybrid EVs) and not BEVs (Battery EVs). This defeats the purpose of scaling-up the nationwide EV infrastructure and decarbonisation plan. Consumers tend to buy PHEVs solely for the lower price point attraction rather than for environment reasons. Until the policy re-focuses on BEVs, Malaysia is unlikely to inspire auto OEMs to bring in their BEV pipelines or to relocate their BEV CKD plans here.”

Among the policies and incentives that governments can consider to boost EV demand are recurring fiscal incentives such as fuel taxes or a dynamic price of electricity, one-time fiscal incentives such as tax exemptions or carbon pricing and non-fiscal incentives such as charging infrastructure, special lane access, free parking, toll exemptions and access to low emission zones.

To leverage on opportunities in EV, ASEAN should look at attracting China’s EV investment and at potential EV partnerships. China has a proven EV model with complete value chain and proven EV companies. ASEAN could be a right-hand-drive EV market for China.