Would You Allow YOUR Malaysian Tax Money To Finance Carsome / UPDATE

Carsome is looking for GLC and EPF funding to help keep itself afloat.

A week ago, we started to peer into Carsome’s historical financials to get some understanding on Carsome’s huge cash-burn and significantly depleted funds post its record USD468 million fund-raise.

Next, we thought it would be useful to peer into Carsome’s business model to get a glimpse of how it could be losing so much money in the pursue of growth and “unicorn” status.

We reflected on the industry pain points and whether Carsome has lived up to its vision “To create the most trusted vehicle ownership ecosystem powered by technology and data”.

Yes, there was a lot of greyness in the used car industry in the past, which caused a lot of distrust amongst used car consumers, financiers and even amongst dealers.

From dealers and agents deliberately mis-pricing and gaming the end-customers, to outright selling “lemon cars” and fraudulent cars. So, is Carsome solving this or perpetuating this?

The Carsome business model doesn’t seem to make any business sense.

Fact, online used car platform Carsome has ‘forced’ many traditional used car dealers to either shut down (retire completely) or change the way they deal with used car buyers.

This is great for used car buyers as the process is clean, simple and transparent. However, and there is a HUGE however the business model has been LOSS making since day one.

Carsome has gained prominence in recent years through nationwide marketing campaigns featuring long retired footballer Eric Cantona.

However, despite its success in the used car marketplace platform, the company has yet to turn a profit and continues to burn through investor money.

This raises the question: how does Carsome make money? Or rather, how does it lose money? One possible reason for their financial struggles could be the significant amount of money lost on used car sales incentives, subsidies and promotions.

Photo caption: These are just some of the promotions being run to encourage car salesmen to refer cars to be sent in for inspection. Other than a per inspection payment, there’s also huge grand prizes in the tens of thousands being given out. UPDATE: This practise has been stopped since June 2022.

A lot of subsidies, incentives and giveaways to car salesmen

Carsome offers customer-facing promotions, which is a common practice for businesses. However, there are additional promotions and incentives hidden from the public eye.

From our discussions with industry participants, we have indeed seen various incentives and promotions announced, both to car salesmen, to trade-in cars to (as well as buy from) Carsome.

Whilst these may be bona fide commissions for referring sellers of vehicles, the significant amount of incentives and subsidies does feel high, unsustainable and bordering “kickbacks” for certain preferential service. UPDATE: Carsome management has taken away this incentive to new cars salesmen as reduce their spendings.

Here’s a common example. Let’s say a retail customer is looking to buy a new car from a dealer and has made a booking. The retail customer has a used vehicle that can be traded-in.

The new car salesman then convinces the retail customer to trade-in the used car to Carsome, in exchange for “securing” a new car faster for the retail customer, or worst still “threaten” that the retail customer will not get the new car, withheld discounts etc.

Question then rises whether the new car salesman was being fair, transparent and was working in the retail customer’s best interest to get the best price for the used car.

Did the new car salesman compare prices across different platforms or other dealers? Or, would the new car salesman only channel to Carsome given the high amount of financial rewards that he/she would stand to personally gain?

Did the new car salesman further gained from pricing arbitrage from what Carsome offered and what the retail customer ultimately accepted? For instance, if Carsome offered RM50,000 to buyout the car and the agent offered RM45,000 to retail customer, then the new car salesman would have pocketed another RM5,000.

Are these high commissions, subsidies, incentives and price arbitrages disclosed to the retail customer?

Would the retail customer get a better price in the open market?

Are these financial rewards and pricing arbitrage paid out also disclosed to LHDN? UPDATE: Yes they have been disclosed.

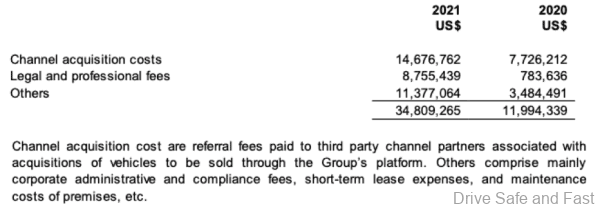

Interestingly, based on the 2021 audited report we previously shared, Carsome indeed spent USD14.6 million in “channel acquisition cost” which may have been these financial incentives given to car salesman.

Assuming 120,000 vehicles were sold in 2021, this implies USD122 (MYR563) “channel acquisition cost” per vehicle.

Has this increased in 2022 contributing to even higher expenses? What is the number in 2023?

We understand that even the authorised new car dealers are having trouble managing their new car salesmen who are more interested in lining up their personal pockets than channel used car trade-ins to their own dealer who are their employer.

Many new car dealers have used car divisions, such as Volvo SELEKT, Perodua POV and recently the VW Das WeltAuto started operations.

Meanwhile, given the high financial rewards that Carsome are giving, would a salesman channel this car to Perodua POV or to Carsome?

Subsidies and incentives are also given to end-sellers and retail customers of vehicles

While it’s challenging to confirm these claims without inside evidence, industry insiders have told us that Carsome is willing to outbid MyTukar’s best offer by RM1,000 to RM2,000.

Sellers are also further incentivized to sell via waiver of seller fees.

Some of the vehicles sold by end-sellers were at “too good to be true” prices – but we have not seen sufficient supporting datapoints which suggest vehicles were systematically bought at high prices and lost money.

Similarly, to drive up retail volumes, there were promotions and incentives that Carsome end up subsidising.

Some of the subsidies and incentives left us scratching our heads as it would be close to impossible to make money on those vehicles. Vehicle sellers are subsidised so Carsome would be buying vehicle at higher prices, and vehicle buyers are also incentivised to purchase.

In a zero sum game world, who gained or lost money? End customers who end up buying more expensive cars, investors’ money or both?

It comes as no surprise that some of the subsidies and promotions may have been deployed during fundraising periods to improve Key Performance Indicators (KPIs) and vanity metrics to impress investors.

One has to ponder if this is a sustainable way of growing the business. Surely at some point all these subsidies will have to stop.

Allegations of round-tripping – is this legal?

In accounting, “round tripping” refers to a series of transactions between companies that inflates the revenue of the companies involved but that, in the end, don’t provide real economic benefit to either company.

While not necessarily illegal, it is important for scrupulous investors and industry participants to be able to recognize when a transaction may amount to round tripping – and, just as important, to know when a transaction that may look like round tripping is in fact legitimate.

Some of the tell-tale signs include inducing and/or incentivising another company to trade, sometimes multiple times but those trades have no real economic benefit.

To illustrate an example: if Company A sells Product A to Company B, then Company B sells the same Product A back to Company A, who then in turn sells the same Product A to Company C. Company A may have recognised revenues twice for the same product.

One of the most recent high-profile “revenue inflation” fraud was Luckin’ Coffee.

So, let’s take a look at whether some of these round-trip allegations levied against Carsome.

This advertisement (above) seems innocent enough. However, if revenues are recognised multiple times and this is encouraged via some form of financial motivation, then it becomes more suspicious.

Let’s say, if Dealer A bought Vehicle A from Carsome and Carsome gave financial rewards to Dealer A for the original purchase. If the same Vehicle A, which may have depreciated in value, is then sold back to Carsome 2-3 months later at the same price plus rewarded with certain incentives, it starts to look suspicious. Not only did Dealer A not lose money (which in itself is a big financial motivation), Dealer A may have gained certain other financial rewards.

Was revenue booked twice in this series of transactions or was it treated as a refund and one leg of the transaction canceled? UPDATE: This above practise has been removed by the Carsome management in order to reduce costs.

Losses exacerbated by syndicates

Given the level of competition, we have also heard that dealers and syndicates have been formed to capitalise on Carsome’s growth ambitions.

For instance, we have been made aware of a few dealers who have gamed the system by selling vehicles pledged and owned by various financial institutions. Carsome paid up money to the dealers who then fled, but Carsome was unable to secure legal ownership of these vehicles. Our investigation indicates that Carsome lost money on at least 11 cars with a total value of at least RM375k.

Despite this having happened, it seems that Carsome continues the practice of paying out money before ebatal by a financial institution is properly secured.

We have heard of allegations of vehicles which had been involved in accidents, floods and written off, or stolen and sold to Carsome, but we had not seen enough evidence to confirm this. But there was indeed a reported stolen vehicle that was sold by Carsome. How did this vehicle end up in Carsome inventory? UPDATE: Carsome bought back the ‘Honda Civic’ in question at full price from the buyer and he used the money to buy another Honda Civic from Carsome.

We have also heard of dealers manipulating prices on Carsome’s platforms. There have been dealers and syndicates who conspired to inflate prices on the platform when selling their vehicles to Carsome, but the “buyer” then walks away after bidding up the vehicle prices.

This means Carsome would have bought in the vehicles at artificially inflated prices, but left to then resell and take losses if they cannot compel the buyers to complete the transactions.

These cases may just be the tip of the iceberg.

Unclear if Carsome and internal Carsome staff have been complicit in fraudulent activities, but we would not be entirely surprised.

Is this the right way to use investors money? You might be wondering, its investors money, not my money, so why should I care if they are reckless with it? Here’s where everything changes…

Carsome wants the government to ask Malaysian goverment entities to pump in more money!

It was reported in Tech in Asia just days ago that Carsome was petitioning the government to recommend them as an investment to the Malaysian government entities to pump in more money to keep Carsome running.

Carsome is trying to get Malaysian entities such as Permodalan Nasional Berhad (already invested in Carro who is backing MyTukar), Khazanah Nasional, Employees Provident Fund, Armed Forces’ Fund Board, Retirement Fund, Petronas Ventures, and Sime Darby (also already invested in Carro) to pump in money, to the tune of at last USD10 million. That’s a huge RM46 million that could be used for tax payers benefits like medical and food subsidies.

How long can RM46 million last? You can check out our previous article on Carsome’s financial status here.

If 2022 EBITDA loss is estimated to have exceeded USD100 million (RM460 million), that’s only 1 month worth of cash burn! Carsome has already silently admitted they have yet to break-even. What is the plan after that? With the current market volatilities, is Carsome even able to IPO? Does the IPO market want a loss making or barely profitable company right now?

Carsome subsequently announced that they have “solid liquidity position of USD150 million”. Well-placed sources indicated to us that Carsome only had actual cash of USD30-40 million as of a few weeks ago. As of 31 Dec 2022, Carsome’s actual cash was about USD55 million which is very close to our estimate.

How did Carsome calculate liquidity and how much of the USD150 million was actual cash? Did you know that car stock is also considered liquid assets, but you can’t pay staff salaries with cars. You have to sell them to get cash. What happens if you want to sell a car quickly than a normal sales cycle… that’s right. More discounts and more losses.

Lets not forget Carsome’s last year purchase of two bankrupt automotive websites, Carlist and Wapcar which is still losing money daily and still only in operations to keep running Carsome editorial, promotions and advertising videos as no other automotive website wants to run any of their advertising and sales promotions.

The question we should all ask ourselves is, with the government having to make some tough choices these days related to targeted subsidies, should money really be wasted being pumped as further investment into this cash-burning “unicorn”, who may not have been transparent about the way it conducts business.