How Non-Mainstream Brands Survive in Malaysia

I have a particular way of categorising cars which some may not agree with, but I find pretty helpful. Basically at the ultra high-end you’ve got the luxury and supercar brands. I did a whole series on these brands that you can read about here:

A tier below that is what I’d call the premium segment. They’re a segment that’s so reliant on brand power that they’ve all mostly come to giving their models particular alphanumerical names and ordered naming structures. I did a whole nomenclature series which you can read about here:

The next tier down is a tough one to crack. They’re all brands that make very competitive products but who don’t have the volume or brand power to take anything for granted. These are the brands that struggle to make huge gains in Malaysia, where cars are overpriced and there are protectionist policies to help local brands thrive.

Here are some of the brands I’d put in this category:

- Ford

- Hyundai

- Kia

- Renault

- Volkswagen

- Peugeot

- Citroen

- Subaru

The common problem for these brands is that their vehicles aren’t able to retain value in the used market (compared to many models from Honda, Toyota, Mazda and maybe even Nissan), so they’re not the first choice for customers unless they can get pricing right. Each brand leans heavily into a unique solution, so to me this is a very interesting part of the market to watch because there’s a lot at risk and brands are trying new things to keep customers interested.

Here’s my take on each brand’s appeal in Malaysia.

Ford

Ford’s passenger car game in Malaysia seems to be at an end. They delivered some truly awesome vehicles but issues with their dual clutch gearboxes pulled customer confidence down. They attempted to regain customer confidence by reintroducing conventional automatics in cars like the Focus. But by 2018, it was clear that the company’s focus would be with its Ranger. With the Ranger, Ford is able to deliver a pick-up truck that feels and looks one price segment above its Japanese competitors. And because they’re made in Thailand and commercial vehicles are taxed less, they’re able to get great pricing for the Ranger. To this day, the Ranger Wildtrak has no real competitor and the Ranger Raptor is genuinely in a league of its own.

Hyundai

Hyundai have done some very bold things in the last 5 years, including introducing the first locally-assembled C-segment hybrid vehicle with the IONIQ. More recently, they introduced the i30 N for performance enthusiasts in the market. While the company has done great to improve the image of Korean cars in this market, two problems hampered their progress is my opinion. One, they were a little behind the trend with SUVs and there used to be a big discrepancy between CKD and CBU material choices. Today, Hyundai offers really great conventional vehicles with reliable mechanicals. For instance, the only CKD C-segment sedan with a conventional automatic today isn’t even Japanese, it’s the Hyundai Elantra. Car buyers looking for this sort of simplicity and great build quality can rely on Hyundai in this market.

Kia

The sister company of Hyundai, Kia, has a slightly different approach to the problem. While many mechanicals are shared, Kia in Malaysia seem to attack every segment with as much value and equipment as they can. Even down to the A-segment, they have cars like the Picanto. Like Hyundai, Kia brought in a high-performance halo car, the Stinger. Unlike Hyundai though, Kia seem to have a bit more to work on in the after sales department, but we’re not sure if this is a perception problem or an actual problem as some Kia owners don’t seem to have many complaints.

Renault

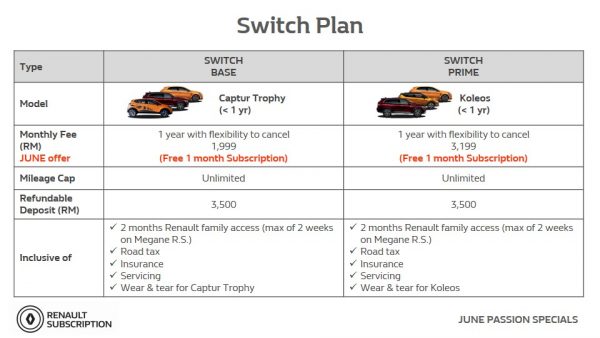

Renault have tried a few strategies, but their latest one is pretty innovative. Instead of focusing on the product side, they’ve introduced a new way of vehicle ownership in the form of car subscription. Not only does this lower the entry cost for potential customers, but it also removes the worry of resale value and servicing costs. Additionally, Renault is able to package other value-added services that would be impossible using traditional car buying options.

Volkswagen

Volkswagen seem to be keeping the focus on their products and offers. But we’re not sure what their long terms strategy for Malaysia is as the new Polo and Arteon are way overdue here. Today the focus for the company seems to be to push as many CKD Tiguans and Passats as they can.

Peugeot

Peugeot are coming in strong with locally-assembled versions of the 3008 and 5008 SUVs. Both offer very attractive designs at reasonably competitive prices. It’s a strong product focus for Peugeot and this seems to work fine for the brand as their vehicles are genuinely good looking and well-packaged.

Citroen

The Citroen brand is undergoing a bit of a change in direction. It used to be the premium arm of PSA, but now DS has taken that role and Citroen is focusing more on creating a sister brand image to Peugeot. Their C3 Aircross is a reasonably priced alternative to the popular HR-V, but has yet to really take off in a big way in the Malaysian market.

Subaru

For Subaru, the brand value is rather strong in Malaysia. The brand keeps its product line relatively abreast of the mainstream competition. The Forester and XV are seen as viable alternatives to the other Japanese SUVs and Crossovers out there and are priced right. Unique Subaru mechanical layouts are what keep the appeal of these vehicles up despite some disadvantages in resale value.